Grand Prix History

The history of Grand Prix Motor Racing through the lives of its greatest drivers, people and events with a special focus on the history of Formula 1 and other iconic racing events.

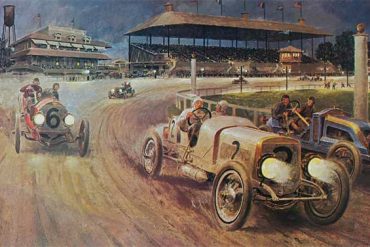

The History of Grand Prix Racing

The dawn of automobile racing was anything but that. It was thought that a car’s ability to navigate roads in a reliable manner was all that could be hoped for. Outright speed was not even considered important that is until the flag dropped …From that day onward racing has been a core part of the story of the automobile. From the first organized races in the late 1800s to the huge technical leaps in recent decades, we take you through the history of Grand Prix racing in our series below.

Motor Racing History

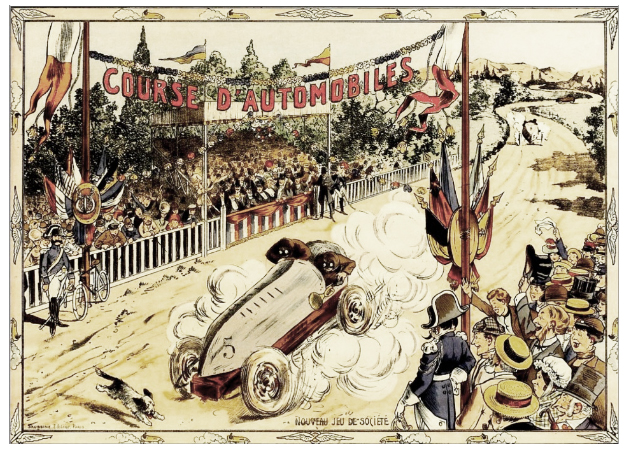

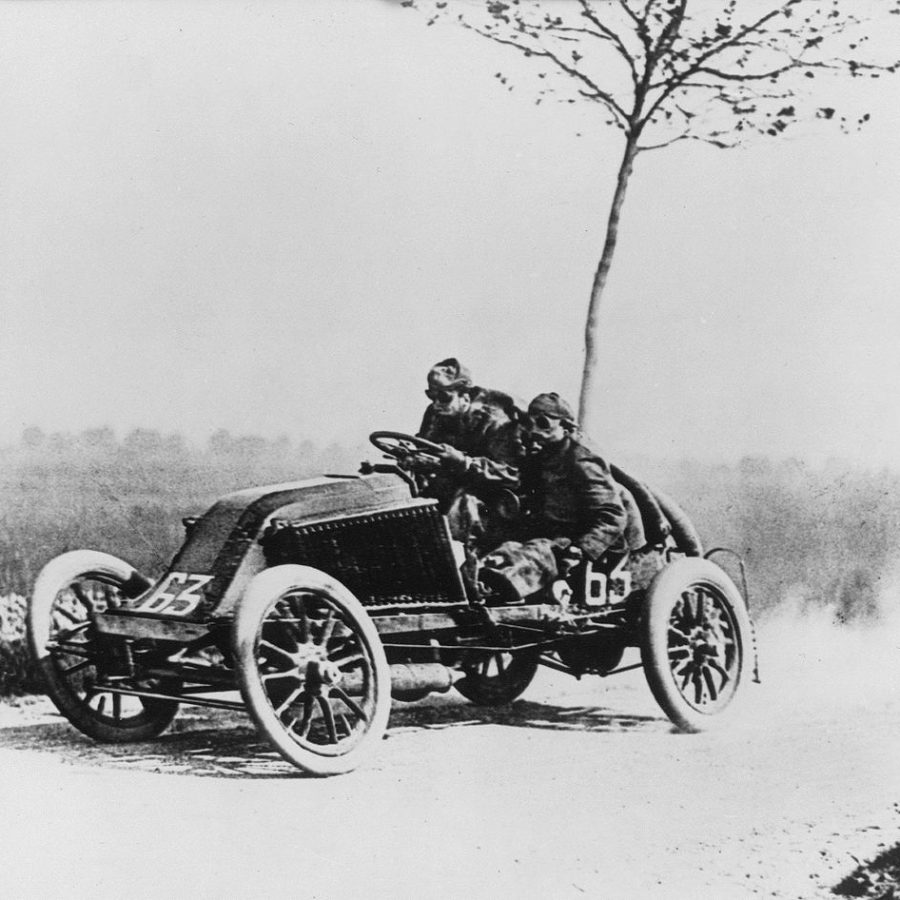

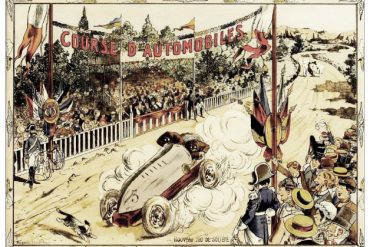

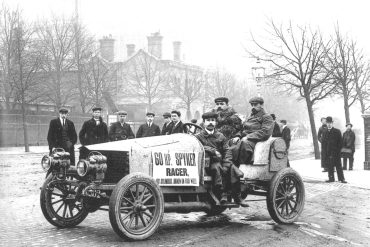

City to City Motor Races

It began with demonstration runs such as one that took place on the 22nd of July, 1894 in front of a fascinated public for these strange carriages that drove themselves or at least seemed to. The trail as it was called would cover the distance from Paris to Rouen and was organized by the journalist Pierre Giffard of Le Petit Journal; a judging-panel decided on the winner. The paper promoted it as 'Le Petit Journal' Competition for Horseless Carriages (Le Petit Journal Concours des Voitures sans Chevaux) that were not dangerous, easy to drive, and cheap during the journey, the main prize being for the competitor whose car comes closest to the ideal. De Dion Steam QuadricycleThe announcement in Le Petit Journal on 19 December 1893 expressly denied that it would be a race - ce ne sera pas une course. The easy to drive clause effectively precluded from the prizes any vehicles needing a traveling mechanic or technical assistant such as a stoker. While the event drew huge crowds the organizers soon realized that the criteria for judging a winner was lost upon the spectators who would show up to watch, what for them was a spectacle. Something else needed to be done to allow a manufacturer to promote the superiority of their product for inventions were all well and good but this was no scientific exercise, cars needed to be sold. The obvious solution was something that was denied at Paris-Rouen, a race and with the victory goes the spoils. Reliability was what the manufacturers were after but the public would crave speed.... to learn more click the link below

Mille Miglia

When I talk about the Mille Miglia, I feel quite moved, for it played such a big part in my life. I knew it as a driver, a team director and a constructor ... and was always an admirer of its champions. In fact, the Mille Miglia not only provided enormous technical advances during its three decades, it really did breed champions. I was present at every one of the twenty-four Mille Miglias that were run and was numbed by the tragic accident in 1957 when the marchese de Portago was killed driving one of my cars, causing the race to be banned. In my opinion, the Mille Miglia was an epoch-making event, which told a wonderful story. The Mille Miglia created our cars and the Italian automobile industry. The Mille Miglia permitted the birth of GT, or grand touring cars, which are now sold all over the world. The Mille Miglia proved that by racing over open roads for 1,000 miles, there were great technical lessons to be learned by the petrol and oil companies and by brake, clutch, transmission, electrical and lighting component manufacturers, fully justifying the old adage that motor racing improves the breed.... to learn more click the link below

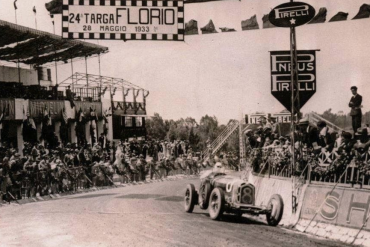

Targa Floria

In 1905 while attending a sporting competition Vincenzo Florio was asked by Henri Desgrange, editor of L'Auto and founder of the Tour De France: "Why do you not have a motor race in Sicily?" Florio startled by the question could only respond: "Why, because we have no roads." Upon his return home he had his associates look into the matter of road and they convinced Florio that a course could be built. The Targa Florio was not so much a race as it was an ordeal. Established in 1906 a single lap at la Madonie, East of Palermo was approximately 92 miles. Besides the course which traversed mountain roads unchanged since the Punic Wars, there were severe changes in climate, bandits and wolves..... to learn more click the link below

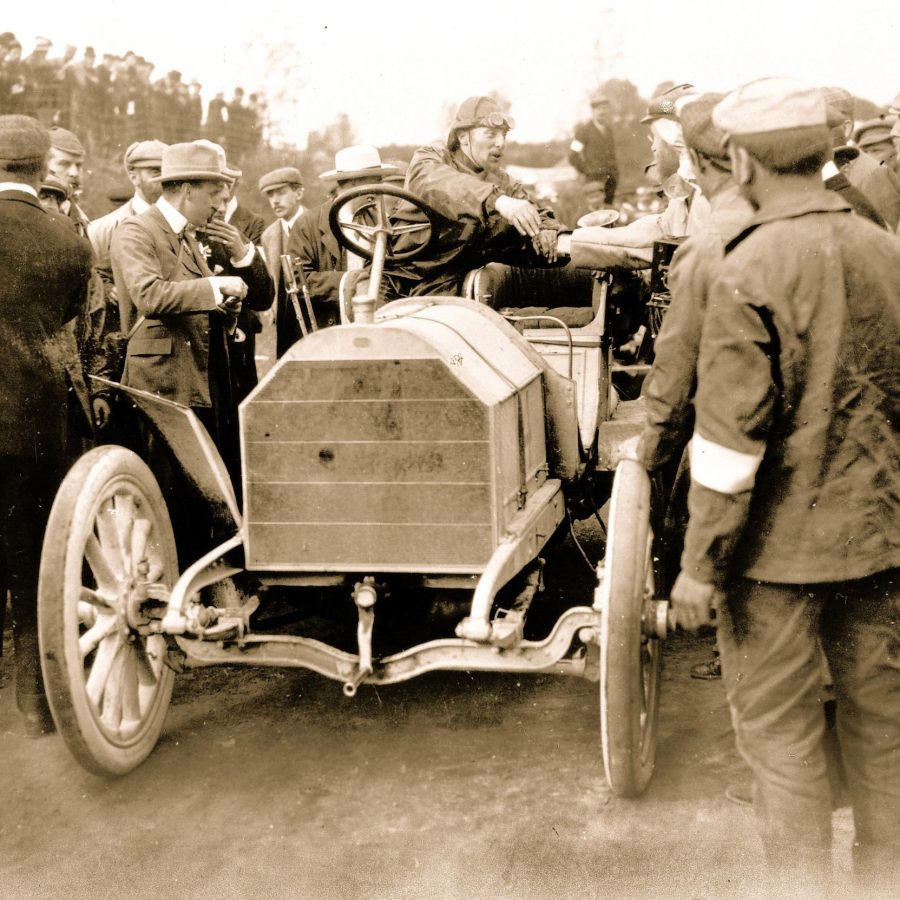

Gordon Bennett Cup

In 1899 Gordon Bennett offered the Automobile Club de France (ACF) a trophy to be raced for annually by the automobile clubs of the various countries. The trophy was awarded annually until 1905, after which the ACF held the first Grand Prix motor racing event at a road course near Le Mans. The 1903 event in Ireland possibly gave rise to the birth of British Racing Green. The Gordon Bennett Cup auto races drew entrants from across Europe, including future aviator Henry Farman, and competitors from the United States such as Alexander Winton driving his Winton automobile. Under the rules, the races were hosted in the country of the previous year's winner. As the races were between national teams, it led to the reorganisation and standardisation of national racing colours.

Grand Prix Racing

The dawn of automobile racing was anything but that. It was thought that a car's ability to navigate roads in a reliable manner was all that could be hoped for. Outright speed was not even considered important that is until the flag dropped ...The first event to have been planned was to have been a short trial in Paris organized by "Le Velocipede" in 1887, but only one competitor turned up and so it was abandoned. The first organized event was actually a Reliability Trial run from Paris to Rouen in 1894 over a distance of 126 km. It was organized by a newspaper, Le Petite Journal, and the winning "horseless carriage" had to be "safe, easily controllable and reasonably economical to run." Twenty one entries left Paris on July 22nd, and the first home was Count de Dion in a steam driven De Dion tractor. Unfortunately for De Dion, the jury decided that his car was not a practical road vehicle and instead awarded the prize jointly to the next two leading cars, a Peugeot and a Panhard-Levassor respectively..... to learn more click the link below

Canadian - American Challenge Cup

John Bishop, Executive Director of the Sports Car Club of America as his Competition Director, Jim Kaser to look into the possibility of forming a professional sports car series, one with a more international flavor than it's US Road Racing Championship (USRRC). The Canadian - American Challenge Cup was a joint effort of two clubs: the Sports Car Club of America (SCCA) and the Canadian Automobile Sports Club (CASC). It continued in its original form through 1974. In 1971, it was officially recognized by the FIA giving it international prestige. The Can-Am series began in 1966 with two races in Canada (CAN) and four races in the United States of America (AM) for what were to become known as Group 7 sports cars. These racing cars were not mass produced, but instead manufactured in small quantities or as single units. The FIA’s Group 7 regulations specified no engine capacity limit, and turbochargers and compressors were allowed. There were no other technical restrictions. In theory, all the cars needed for approval were two seats, bodywork which enclosed the wheels, and a roll hoop. They therefore came very close to creating a dream “anything goes” scenario for many race car designers. The series would foster a number of radical designs and one company that would set an American standard for innovation, Jim Hall's Chaparral Cars, yet the series was dominated by the efficient New Zealanders at Bruce McLaren Racing.... to learn more click the link below

The Greatest Grand Prix Races

The best races from the best sport in the world. We take a look at the best grand prix races ever held. From dramatic finishes to controversial events and historical moments, here are our rankings for the best races ever.

Great Auto Races

We take you through every important automotive race. From the first city to city races through to iconic Grand Prix races and driver favorites, we cover them all.

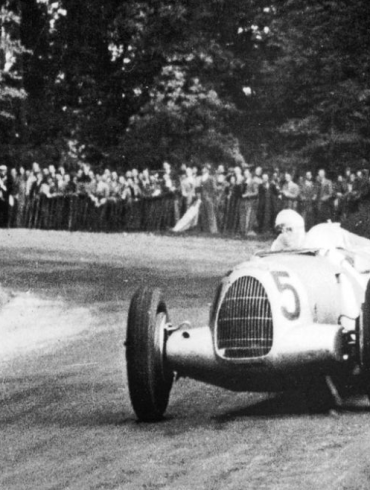

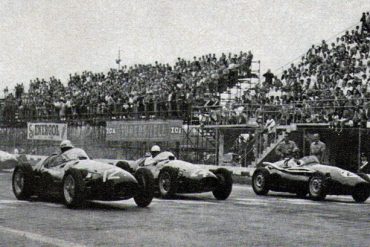

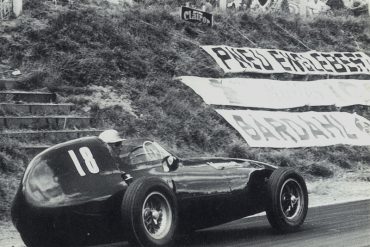

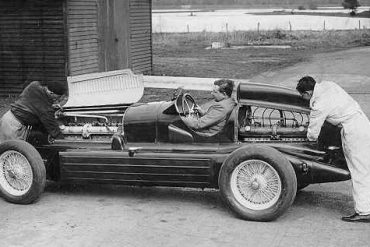

Grand Prix Racing Cars

The race cars that defined Grand Prix racing since the early days. We have broken these cars into three broad groups. The pre-war cars that were really the world's first formal race cars. The names are forgotten but note that these were special cars made by the best of the best of the era. The next group is the post-war grand prix race cars, with familiar names like Bugatti, Ferrari, Maserati and Alfa Romeo all featured. The final group is that of the official era of Formula 1, the post 1950 era of modern F1 cars.

Race Car Profiles

In-depth profiles and stories about the most iconic race cars ever made. From the machines that raced in the early 1900s when motor racing first started to take shape in France to the extreme machines from the Can-Am race series to the current crop of advanced Formula 1 machines and everything in between.

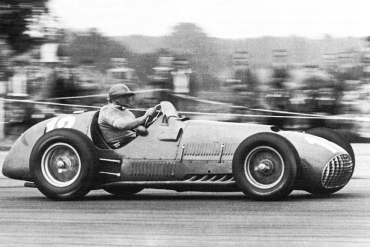

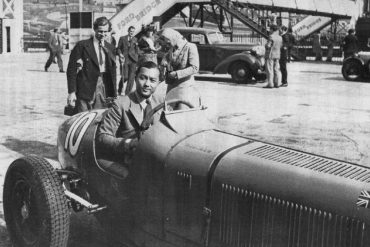

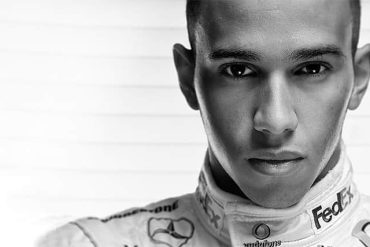

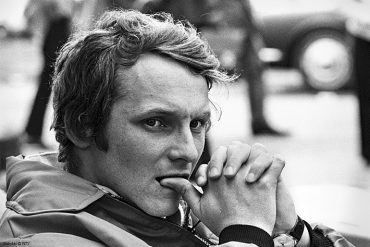

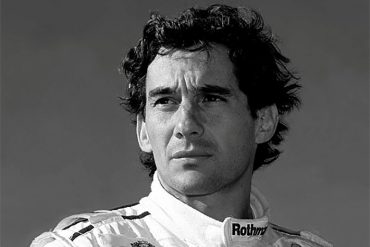

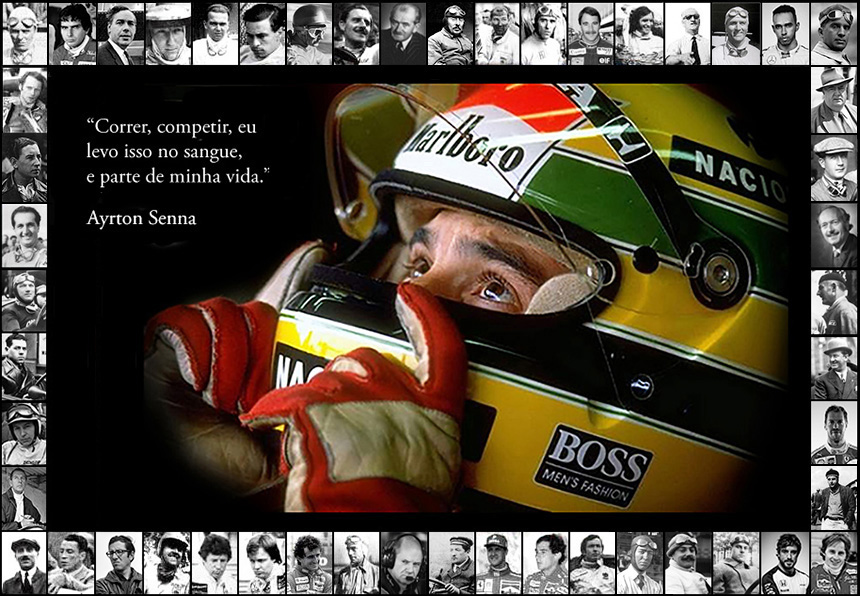

The Best Racing Drivers

Grand Prix racing has produced many household names and fan favorites. Drivers like Michael Schumacher or Lewis Hamilton are often mentioned as the GOATs of Formula 1, but those names ignore the epic racing drivers of yesteryear. Senna, the amazing Brazilian driver was known for his spectacular driving and propensity to take risks. In the same era, we have Alain Prost, who despite registering four World Championships and more than 50 wins, Alain Prost’s success could have been even greater. Niki Lauda may not have the most titles, wins or poles, but the Austrian cannot be left off such a list. Going further back, how about names like Jim Clark? Jim Clark was the greatest driver of his time, and he began racing in 1960, having cut his teeth in local rallies and hill climbs around Scotland. Others? How about Jackie Stewart, Nigel Mansell and Fernando Alonso, all amazing drivers who deserve to be part of the conversation.

Grand Prix Drivers & Key People

Biographies and stories about the greatest Grand Prix drivers in history. We also take a look at some of the most influential and important people in and around Grand Prix, Formula 1 and other racing events.

More Grand Prix History

We have lots more history, in-depth profiles, race cars and stories.